VCT investment helping UK businesses scale internationally as two-thirds of Octopus Titan VCT portfolio companies expand beyond Europe

Octopus Investments, part of Octopus Group and the largest provider of venture capital trusts (‘VCTs’) in the UK1, today announced it has opened a new fundraise for Octopus Titan VCT, managed by Octopus Ventures.

Octopus is targeting another £120 million fundraise for its flagship VCT. This follows last year’s record breaking fundraise when Octopus Titan raised a total of £230 million. If fully subscribed, the total fund size could rise to almost £1 billion AUM, acting as a crucial source of capital for early stage businesses across the UK.

Octopus Titan offers investors, comfortable with the risks of smaller company investing, attractive tax incentives and access to a well-established and diverse portfolio of more than 70 potentially game-changing smaller companies.

Octopus Titan VCT backs pioneering entrepreneurs

Octopus Titan’s 30 strong investment team is one of the largest in Europe, and backs pioneering entrepreneurs with ambitions to radically disrupt their industries. In the last year2 Octopus Titan VCT has invested £43 million in 15 new companies.

One such example is Cazoo, which is aiming to transform the way people buy used cars in the UK. Cazoo was founded by Alex Chesterman who previously founded Zoopla Property Group, another company that Octopus Titan invested in in 2008, and which was the first VCT backed business to reach a £1bn valuation.

In the last year3, Octopus Titan also provided £76 million of ‘follow-on’ investment into companies already in its portfolio. For example, it first invested in Elvie in 2016, and in May this year joined its latest £32 million Series B fundraise, a record for a femtech company. Founded by Tania Boler, Elvie’s mission is to improve women’s lives through smarter technology and is the creator of the world’s first silent breast pump.

Impact of VCT investment

The latest data shows Octopus Titan is proving effective at helping UK companies scale.

Supported by the team’s presence in New York, San Francisco, Singapore and China, its portfolio, which are typically headquartered in the UK, have become increasingly international. Two thirds (65%) of the portfolio now have an international office and are generating revenues from outside Europe4.

This contributed to 45% revenue growth across the portfolio in the previous year, rising to 56% in the top 10 holdings5. Companies in Octopus Titan’s portfolio also created more than 700 new jobs in the latest year recorded6 adding to the more than 2,000 jobs created in the previous three, clearly demonstrating the valuable economic benefits that VCTs provide.

Paul Latham, Managing Director at Octopus Investments, said:

“VCTs have become a vital part of the UK’s entrepreneurial ecosystem and provide funding for hundreds of innovative businesses across the country. Just looking at Octopus Titan, the positive impact of VCT investment is huge, driving significant revenue growth and creating thousands of new jobs. Investors are increasingly aware if this too, and many like the idea of backing smaller companies and contributing to their success.”

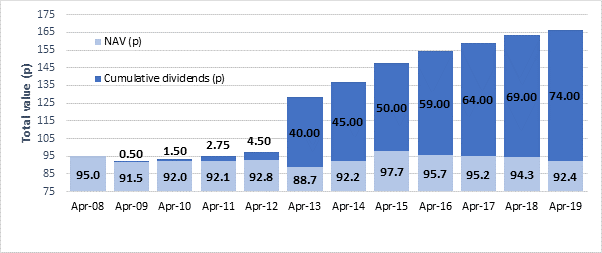

VCTs offer investors up to 30% upfront income tax relief providing that shares in the VCT are held for at least five years, as well as tax-free dividends and tax-free growth. Octopus Titan has an impressive track record of paying dividends and targets paying 5p per share annually. Since it was first launched in 2007 it has paid total dividends of 74p per share to investors.

Jo Oliver, fund manager of the Octopus Titan VCT, commented:

“With one of the largest Venture investment teams in Europe, we get to see thousands of investment opportunities every year and meet hundreds of businesses. We’re looking for truly pioneering entrepreneurs, which means the bar for investment is extremely high, but we are constantly impressed by the incredible talent in the UK. This reflects the continued evolution of the UK venture ecosystem which is now one of the best places to build world class technology companies. Our track record also means successful serial entrepreneurs come back to us when they launch their new venture, with the Zoopla and LoveFilm founder Alex Chesterman and his new business Cazoo being a perfect example.”

Octopus is one of just two VCT providers to offer an ISA wrapper on a VCT. This enables investors to transfer any existing ISA funds (from previous tax years 2018/19 or prior) to a new Titan VCT ISA, while maintaining all the benefits of VCT investing.

The share offer is open until September 2020 but may close earlier if fully subscribed. The minimum investment is £3,000 while the maximum investment qualifying for tax relief is £200,000.

– Ends –

Notes to Editors

(1) The Association of Investment Companies (The AIC) – Interactive Statistics – as of 22nd August 2019

(2) Between the periods of 1st May 2018 – 30th April 2019

(3) Between the periods of 1st May 2018 – 30th April 2019

(4) Octopus Ventures, comparison of 2018 calendar year vs. 2017.

(5) Top ten holdings by value – Octopus Ventures, comparison of 2018 calendar year vs. 2017

(6) Octopus Ventures, comparison of 2018 calendar year vs. 2017.

About Venture Capital Trusts

Venture Capital Trusts (VCTs) were introduced by the government in 1995 to encourage much-needed investment into smaller companies, driving job creation and economic growth in the process. They offer a number of tax incentives for those investors comfortable with the associated risks of smaller company investments, including up to 30% upfront income tax relief providing that shares in the VCT are held for at least five years, as well as tax-free dividends and tax-free growth. Whilst these incentives are subject to certain HMRC legislation and personal circumstances they remain very attractive for those willing to put their capital at risk through investing in a VCT.

Octopus Titan VCT- five-year performance

| Year to 30 April | 2015 | 2016 | 2017 | 2018 | 2019 |

| Annual total return % | 11.4% | 7.2% | 4.7% | 4.3% | 3.3% |

| Annual dividend yield | 5.4% | 9.2% | 5.2% | 5.3% | 5.3% |

| Total value (pence) | 147.7 | 154.7 | 159.2 | 163.3 | 166.4 |

| NAV (pence) | 97.7 | 95.7 | 95.2 | 94.3 | 92.4 |

| Cumulative dividends (pence) | 50.0 | 59.0 | 64.0 | 69.0 | 74.0 |

The Net Asset Value (NAV) is the combined value of all the assets owned by the VCT after deducting the value of its liabilities (such as debts and financial obligations), NAV is shown in pence per share for the year. The performance information above shows the total return of Octopus Titan VCT for the last five years to 30 April, the VCT’s interim accounting period. The annual total return for Octopus Titan VCT is calculated from the movement in net asset value (NAV) over the year to 30 April, with any dividends paid over that year then added back. The revised figure is divided by the NAV at the start of that year to get the annual total return. Performance shown is net of all ongoing fees and costs. The annual dividend yield is calculated by dividing the dividends paid per annum by the NAV at the start of the period. Please note, the NAV per share may be higher than the share price, which is the price you may get for the shares on the secondary market. Total value is calculated as the sum of the NAV per share and cumulative dividends per share for the last five years to 30 April.

Octopus Titan VCT cumulative total value since inception

The performance information above shows the total value of Octopus Titan VCT from inception to 30 April 2019, the VCT’s latest interim accounting period. The total value figure is the sum of the net asset value per share (“NAV”) as at year end, and the cumulative dividends paid per share from inception to that period end. Performance shown is net of all ongoing fees and costs. Please note, the NAV per share may be higher than the share price, which is the price you may get for shares on the secondary market.

For journalists in their professional capacity only. The value of an investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest. Tax treatment depends on individual circumstances and may change in the future. Tax reliefs depend on the VCT maintaining its VCT-qualifying status. VCT shares could fall or rise in value more than other shares listed on the main market of the London Stock Exchange. They may also be harder to sell. Past performance is not a reliable indicator of future results. Personal opinions may change and should not be seen as advice or a recommendation. We do not offer investment or tax advice. We recommend investors seek professional advice before deciding to invest. Investors should only subscribe for shares based on information in the prospectus and the Key Information Document, which can be obtained from investments-old.production.octps.co. Issued by Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London, EC1N 2HT. Registered in England and Wales No. 03942880. We record telephone calls. Issued: September 2019.