If you happen to own any bitcoin, the highest-profile example of a ‘cryptocurrency’, then congratulations. As recently as 2015, an individual bitcoin was valued at $250. In November, people were speculating that bitcoin was wildly overvalued at $10,000. Since then, it has kept breaking records, and at the time of writing was valued at close to $19,000. Who knows what the price will be by the time you read this? And that’s part of the problem. Bitcoin valuations can move up or down by hundeds or thousands of dollars in a single day, and no-one knows what the price will be from hour to hour. It’s no surprise that bitcoin owners sitting on huge ‘paper’ gains are feeling increasingly anxious – holding bitcoins must feel like riding a rollercoaster

The growth of Bitcoin

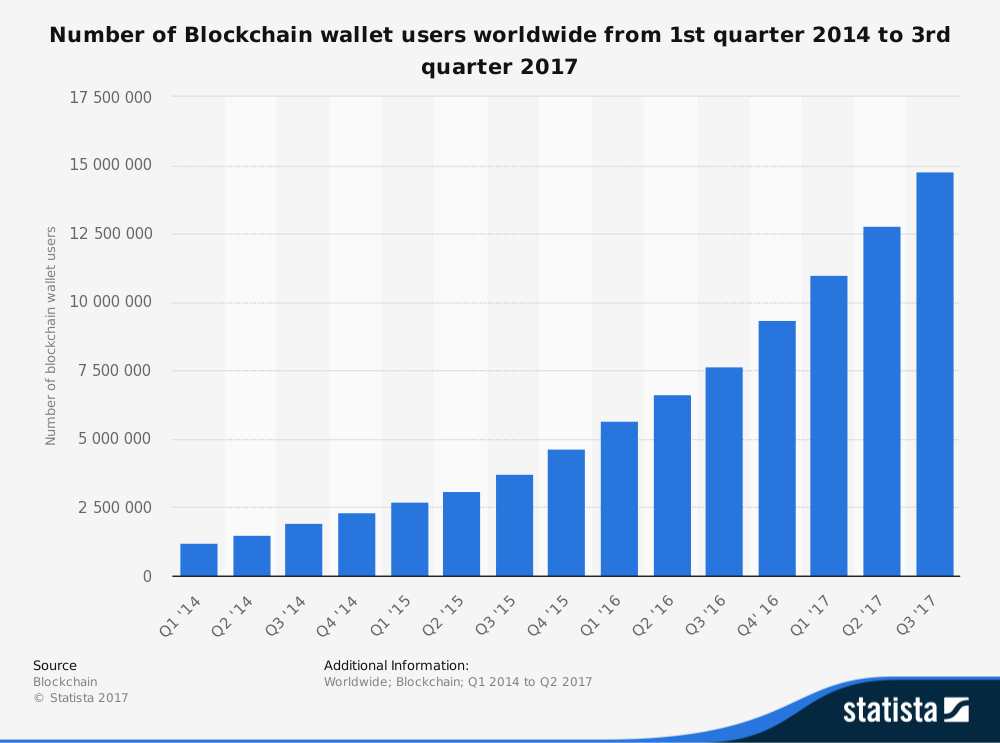

According to statista, there are currently close to 15 million digital ‘blockchain’ wallets holding bitcoin or other cryptocurrencies, although that number has most likely increased signifanctly in the last three months. Bitcoin currently conducts around 330,000 transactions daily. To put that into perspective, the global payments business VISA clears 100 million transactions every day. So while bitcoin offers great potential as a form of currency, its still very much a tiny upstart compared to traditional financial transaction methods. But that looks to be changing.

Bitcoin is on its way to achieving mainstream awareness, if not quite respectability. Bitcoin futures are now available to buy and sell on CME, the world’s largest exchange. In the first three hours of trading, almost $50 million in bitcoin futures changed hands. This is a significant step in the evolution of cryptocurrencies. Previously, anyone interested in owning bitcoin had to have a digital wallet and either ‘mine’ it, or buy it. Now, investors can speculate on the future price of bitcoin, as they can with shares, bonds, gold, sugar, and hundreds of other commodities. Of course, with more buyers and sellers comes more price volatility, and even more speculation and talk of bubbles bursting.

A closer look at blockchain

It’s understandable that talk of cryptocurrencies is focusing on valuations. But it’s important to remember that one of the reasons behind their success is the enormous long-term potential offered by the blockchain concept. Here’s how to think about blockchain. Imagine an entire network of information, but where every member has access to all of the information, at all times. When any member updates a piece (or block) of information, everyone else’s block instantly updates (theoretically at least – at present heavy volume causes settlement speed issues). And, even better, every member also knows the wallet ID of who made the change, and when.

What makes a blockchain so special? Well first, it’s very secure. Wallet access is stored cryptographically, and shared with every member. So there’s no way to reverse or alter a transaction. The level of ‘quantum’ computing power required to hack cryptographic algorithms simply doesn’t exist today. And hacking a blockchain would involve gaining access to every single block of information, and every single member device (or ‘node’). So the more members in the blockchain, the more secure it is.

Another benefit is that nobody ‘owns’ the blockchain. It’s not like a traditional bank, where you pay for the privilege of them holding your money. Because there’s no ‘middleman’ conducting the admin (which means no admin errors), costs are lower. Members communicate ‘peer-to-peer’ rather than through an institution serving its own best interests. So it’s no surprise that different industries have been attracted to blockchain as a way for members to innovate. They can even add their own program code in what are called ‘smart contracts’, which makes transactions and interactions much more flexible and democratic.

And it’s really no surprise that cryptocurrencies built on blockchain have taken off in a big way. With a dollar bill, there’s no way of knowing who owned it before you did, and how it was acquired. But with bitcoin there’s a verifiable audit trail of every coin in existence.

But don’t expect cryptocurrencies to start replacing cash anytime soon. For a start, bitcoin owners have great difficulty in trying to actually spend it. As one bitcoin owner complained over Twitter: “Is it really money if you can’t use it nor convert it to anything else?” But for many people, bitcoin will be known ultimately as the first form of cryptocurrency. Think of it as Neanderthal man, eventually superceded by its more sophisticated and capable human counterpart.

Is Ethereum the next evolutionary leap?

Ethereum is a specific blockchain that has seen huge growth in the last 18 months, and is already being viewed as the most exciting application of open source blockchain to date. The ethereum environment lets people build their own blockchain applications, or Dapps, on top of the Ethereum blockchain infrastructure. There are currently around 500,000 unique transactions a day on Ethereum, and the number of Ethereum wallets is currently growing at 400% a year or about 50,000 a day. The more people that create wallets and the more people that build applications on top of Ethereum, the more the value of ether, the unit of measure on Ethereum blockchain, will grow.

Some people believe Ethereum has more potential than bitcoin for a few reasons. These include the ability to conduct a higher number of transactions, faster confirmation times, lower costs and a better governance model. The fact that anyone can build their own token using Ethereum’s great open source technology means people are using it for real business ideas. Those ideas can be serious or frivolous. A game called Cryptokitties, which uses Ethereum to let players buy and customise their own digital ‘pets’, hit the headlines in early December, as the large number of transactions caused the network to slow down drastically. It just shows that once an idea takes hold, the outcomes can be entirely unpredictable.

Which brings us to the title of this blog. What, if anything, does bitcoin have in common with sardines? The answer is speculative trading. In his book Margin of Safety, Seth Klarman told the story of time when the price of sardines soared after the fish started disappearing from its habitat in Monterey California. Once sardines became a scarce commodity, the price of a can soared:

“One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”

Where to next?

There is increasing global distrust of institutions driven by scandals, fines and data fails and this coupled with an increasingly digital and global economy paves the way for a decentralised digital and global currency. It’s no surprise that bitcoin was born out of the 2008 global financial crisis, when traditional banks losts billions of dollars by speculating on assets that were wildly overvalued. It’s ironic that bitcoin is now headed in the same overhyped direction. But regardless of the short-term or long-term success of bitcoin, bloockchain represents a clear paradigm shift. Richard Wazacz, CEO and co-founder of Octopus Labs, believes we’re just experiencing the tip of the iceberg:

“Cryptocurrencies, tokens and blockchains represent potentially one of the most innovative concepts to hit, not just financial services, but every sector where data and information needs to be transmitted and stored with integrity. The utility of the many concepts being built today will pull value from centralised corporates that currently control our information and charge us for using it and redistribute around participants in that system. It’s hugely exciting.” Richard Wazacz

We live in a world where our personal data is collectively worth millions. Cryptocurrencies could help us move away from a world where corporations control our information (e.g. our identity, our financial status, even our internet browser history), and use this centralised data to generate profit, to an economic model where users have the ability to control when and how companies see and use their data. They will even be able to choose how to get compensated for it. This won’t happen immediately, and there will be numerous hurdles along the way, but it will happen.

As Richard Wazacz points out: “Milton Friedman called it 20 years ago, when he said “the internet is going to be one of the major forces for reducing the role of government…the one thing missing is a reliable e-cash where person A and can transfer funds to person B without A knowing B, or B knowing A… and there is no record of it happening”. Whether this e-cash is bitcoin or something else, we cannot say until we see much greater real-use adoption.”