Octopus Group: UK care homes case study

Key facts

Managed by: Octopus Real Estate

Founded: 2010

Parent company: Octopus Group (founded in 2000)

Location: Various, UK

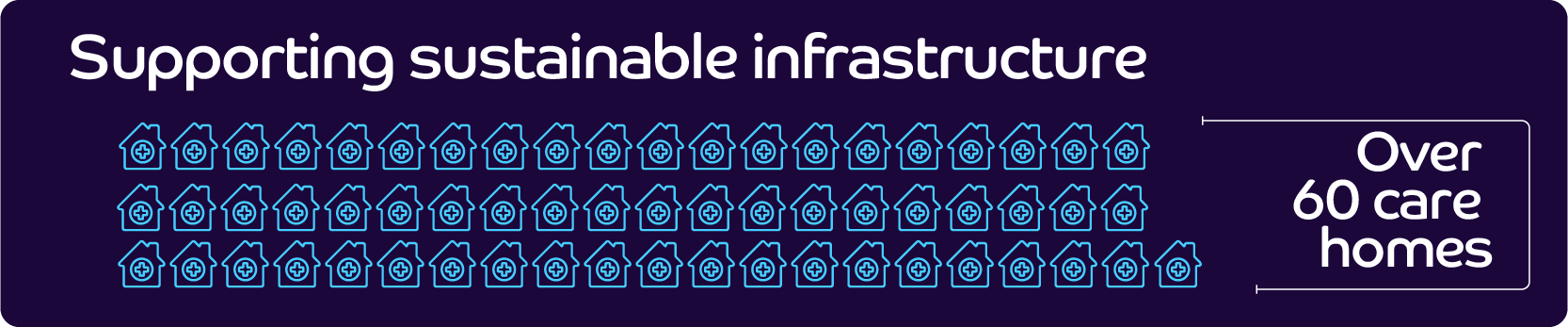

Care homes in portfolio: Over 60

Care beds provided: Over 3,800

Overview

Octopus investment into UK care homes supports the health and well-being of our elderly population

On a mission to build a brighter future, Octopus looks for investment opportunities in sectors where a little extra care and attention would allow them to flourish. Renewed focus on these areas can also lead to an improvement in the lives of the people who use them, as well as benefitting society as a whole.

Since 2010, Octopus Real Estate has been investing in the UK care home market. Currently, the company has a portfolio more than 60 high-quality care homes in the UK, which provide care beds for around 3,800 residents.

Overcoming challenges

The care home market, including nursing and residential care, continues to face many challenges. The UK’s population is ageing rapidly, yet quality facilities that can enrich residents’ lives are in short supply. The sector needs access to finance to build modern, purpose-built properties to meet this demand.

Identifying this opportunity, Octopus has successfully delivered a strategy to provide hands-on investment to this under-supplied sector. The company funds care homes as a real estate investment, then leases the completed facilities to leading operators who are responsible for running them.

Hands-on investing

The Octopus team benefit from years of experience and knowledge in their core markets. In part, this expertise comes from the company’s policy of hiring people who have spent time working in these markets. Sheila Hendy is one example, bringing over 40 years’ experience as a registered nurse to her role as Clinical Assurance Director for Octopus Real Estate.

Hendy sits on the Octopus Clinical Assurance Board, which was started in 2014 to promote a culture of best practice across its healthcare investments. “One of the first things the board set up was a Quality Care Forum (QCF),” she explained. “We invite all of our operators (tenants) along to regular free sessions every year in London, where we put on a full day of education and training.”

The events provide useful knowledge for attendees and are also great opportunities for networking. “Sometimes being an operator can be isolating,” Hendy said. “It’s nice to bring together the registered managers who are responsible for these care homes with other quality managers to share best practices.”

Additionally, the Octopus QCF events help operators stay up to date with the latest policy developments and best practice laid out by England’s Care Quality Commission (CQC), something that is essential for anyone operating in this heavily regulated sector.

“Usually our QCF events include sessions with lawyer from a health care regulatory background,” explained Hendy. “They brief the operators with their up-to-the minute knowledge of what’s going on in the regulatory world.”

Maintaining quality care homes

Regular visits are another key part of the Octopus commitment to maintaining the quality of the care homes they own. Hendy and her colleagues in Octopus Real Estate visit the care homes at least twice a year. They use their visits to build solid relationships with care home operators, as well as to make sure the homes have everything they need to offer high-quality care.

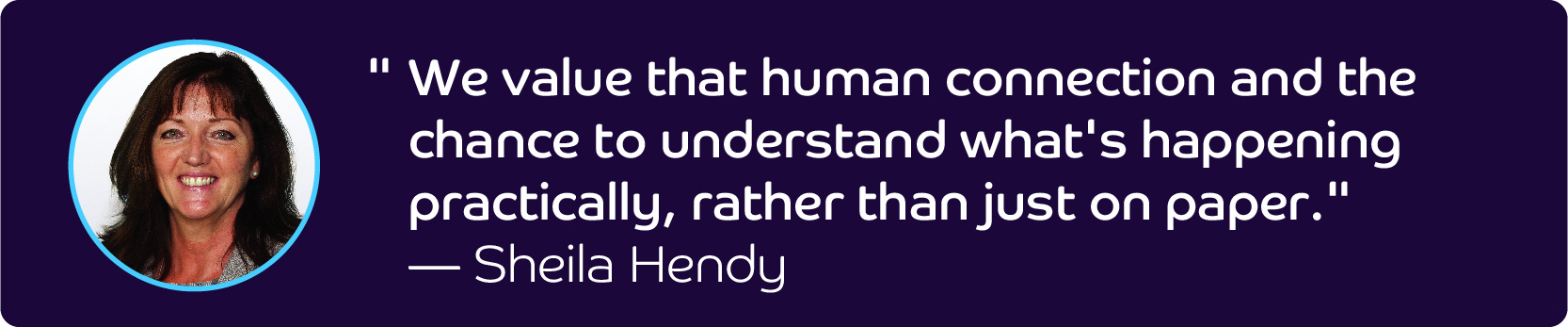

“We meet with staff from different levels of each operator. One day it might be the group director of operations, another the quality team, or the registered manager at a care home. We will offer support for all of them,” Hendy noted. “We value that human connection and the chance to understand what’s happening practically, rather than just on paper.”

Jacob Hurtley, Property Manager at Octopus Real Estate, believes the benefits of regular communication and information sharing are mutual. “Often a care home doesn’t need our direct help, but by building strong ties we want to make operators feel supported. At the same time, they keep us informed and let us know early if any issues do arise so that we can help solve them quickly” he said. “By getting to know key individuals, and genuinely being interested in how the care homes in our portfolio are operating, we can get in-depth operating information that we simply couldn’t get without an active approach. And we can help share best practice. We believe this hands-on approach sets us apart as a landlord.”

And if the team does come across a care home that needs some help to hit the CQC’s standards, they are quick to offer tangible support. Together with her Octopus colleagues, Hendy builds service improvement plans and governance frameworks for care homes that need help, calling upon the knowledge she has gathered over her decades of experience in the field.

Reassuring investors and operators

Hendy’s years of experience are extremely beneficial when it comes to reassuring the institutional investors who back Octopus Real Estate, allowing her to accurately interpret CQC inspection reports and communicate clear risk profiles to these investors.

Often, these institutional investors accompany the Octopus team on visits to care homes too. “The investors really benefit from those interactions because we can bring the investment to life for them,” Hendy explained. “It becomes about more than just property. It becomes more real when they can see the impact their investment is having firsthand.”

But when care home operators chose to restrict visits to only essential ones in the face of COVID-19, Octopus naturally paused its visits as well. And to ensure continued support during the pandemic, the Octopus team set up virtual lines of communication. Videoconferencing sessions provided care home managers with as much support as possible during this challenging time, including reassurance and up-to-date facts and figures.

“A lot of care homes deal with viruses and infections on a regular basis, but they still needed updated information to deal with COVID,” Hendy said. “It’s about having confidence that what they’ve got in place is appropriate. When dealing with a health crisis of this proportion, care homes needed all the support they could get.”

By taking an active role in communicating and coordinating with the care homes in its portfolio, Octopus Real Estate ensures that its investments provide the best possible quality of care for residents, even during a crisis.