- VC investment into fertility startups trebles in four years – on track to surpass $1bn in 2021

- Automation, robotics, AI, and omics technology expected to make treatments more successful

- New business and financing models helping to make treatment for accessible

- Persistent taboo stops people seeking help and is still a barrier to investment

- Report picks out top fertility startups to watch – chosen by team at Octopus Ventures

The fertility market is undergoing a rapid transformation thanks to a new crop of startups, according to a new report – Future of Fertility – Innovations transforming the fertility landscape – from European VC firm, Octopus Ventures.

Despite growing demand for fertility treatments, with 1 in 7 couples having trouble conceiving1,the market has historically been slow to innovate. However, a raft of early-stage companies are using the latest technology to improve the efficacy and reduce the cost of fertility treatments, developing alternative financing solutions to increase access, as well as tackling the persistent taboo.

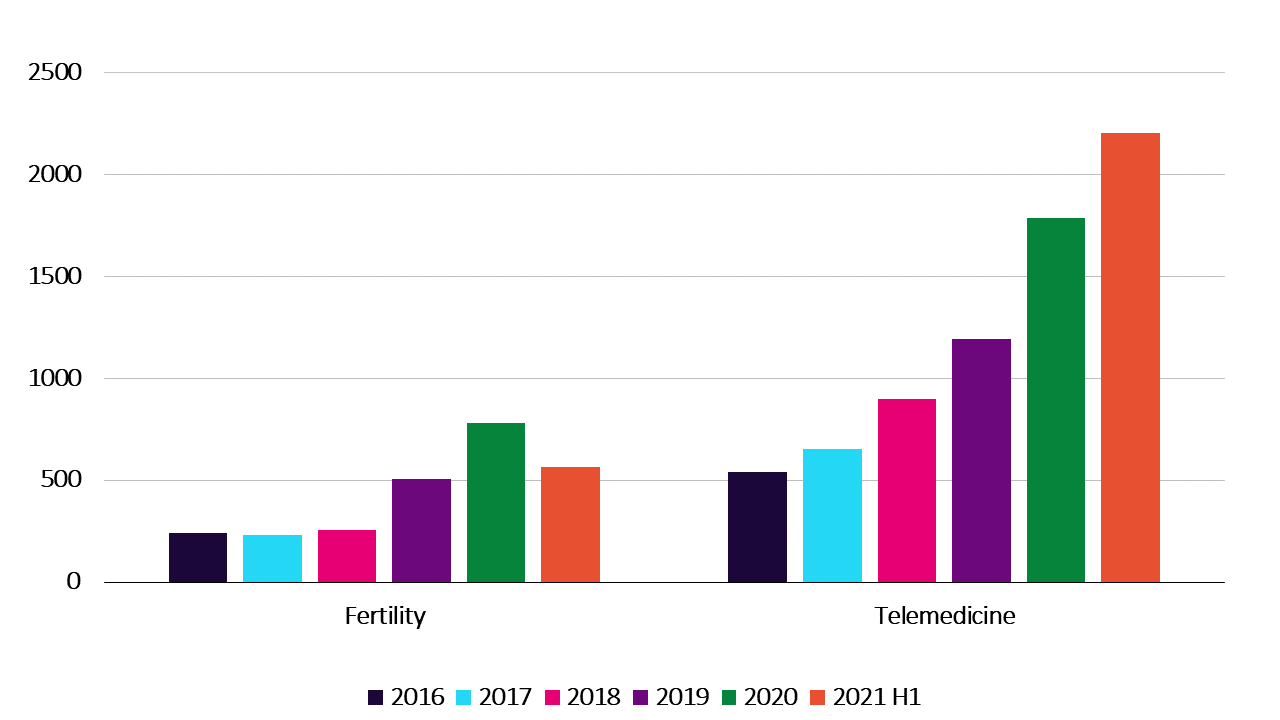

This has been recognised by venture capital (VC) investors, with global funding for fertility related start-ups more than trebling from $240m in 2016 to $782m in 2020. This looks set to be surpassed again this year, with $563m already raised in the first half of 20212. However, it still lags some way behind other sectors in health, such as telemedicine, an indication that more investment is still needed.

Global VC investment ($m)

New technologies set to reduce costs and improve outcomes

While success rates for IVF have improved in the last two decades, they have plateaued more recently3. Meanwhile, a reliance on manual processes and the use of highly skilled labour has contributed to the high cost of treatments and significant variation in their effectiveness.

However, each step of the IVF process, from embryo and sperm analysis to fertilisation, is seeing major innovations, with startups like Overture Life leading the charge. Overture is developing medical devices and novel embryo testing methodologies that will automate all stages of the IVF process, lowering costs and increasing efficiencies for IVF practitioners.

Increasing use of personalised data should also allow for the development of precision treatments tailored to individual patients, while a number of start-ups such as Impli and Bea Fertility have developed new devices that allow for at home monitoring and early interventions.

Alternative financing models

A single cycle of IVF treatment can cost between £5,000-10,000 in the UK or $20,000-60,000 in the US, with no guarantee of a successful outcome, putting private care out of reach of many people. There is also very uneven distribution of publicly funded care in countries such as the UK. In the US, where most people rely on insurance based medical care, coverage for fertility care also remains extremely limited.

In response, companies such as Gaia in the UK and Future Family in the US are tackling the affordability challenge in a novel way by providing outcome-based pricing, essentially replacing the role of insurers by providing smart risk pricing for treatments such as IVF.

A growing number of employers have also started offering fertility services as a benefit to their staff as they seek to attract and retain talent. Startups like Peppy, Fertifa and Apryl are now using this as the primary distribution channel for their solutions and platforms.

Tackling the taboo

Infertility remains a highly stigmatised issue, which means it’s not talked about openly and people delay or avoid seeking help. Many are also unaware of how common a problem it is and mistakenly assume they will be able to conceive easily when they choose. Meanwhile, the average age of parenthood in the UK has been rising steadily among both men and women for almost 50 years4.

Disruptive direct to consumer-brands such as Flo, Natural Cycles, and Mojo have recognised this lack of education and are normalising conversations typically happening in private about menstruation, fertility, and erectile dysfunction. This also has the potential to engage people in conversations about their fertility at a much younger age.

Elsewhere, companies are also building services that promote conversations in underserved communities. LVNDR, the digital clinic for the LGBTQ+ community, is on a mission to change the polarised sexual health care landscape.

Will Gibbs, Principal and health investor at Octopus Ventures:

“The fertility landscape is undergoing a rapid transformation. Over the next decade, we can expect to see very positive changes in terms of the effectiveness and cost of treatment, how we pay for it, and the way we talk about it. All of this should ultimately mean that lots more people are able to access the vital support they need. It’s clear that start-ups are playing an important role in driving this innovation forward, which is reflected in the big jump in venture capital funding. It’s an incredibly exciting time to be an investor in this space and we believe there is a huge opportunity to build some very meaningful businesses.”

Dr Stephanie Kuku, Senior Consultant at Hardian Health and Senior Advisor for the Dept of Digital Health & Innovation at the World Health Organisation:

“Without breaking the taboo around talking about fertility and reproductive health, it will remain underfunded relative to other areas of health. This in turn creates a vicious cycle where the total addressable market is persistently under-estimated, and the deeply technological solutions required to accelerate the field don’t get the investment they need.”

Stuart Lavery, Director at Aria Fertility and Divisional Clinical Director of Women’s Health at UCLH:

“Despite all the advances in our field, the last major development to cause a meaningful improvement in success rates was more than 27 years ago. The good news is that we’re now starting to see the adoption of new technologies, with increased use of robotics, automation, and machine learning, which all have the potential to reduce costs and make treatment more accessible.”

Dr Pooja Sikka, Partner and health investor at Octopus Ventures and practicing GP:

“Fertility issues are an incredibly common anxiety, but it’s still a problem that feels embarrassing to talk about, which means people avoid seeking help until much later in the process, when their chances of conceiving are even further reduced. That’s where I think there is a real opportunity for new digital platforms. If we can get people thinking properly about their fertility when they’re younger and give them the information to make smart decisions, it could have a huge impact.”

Nader Al Salim, CEO and founder of Gaia:

“Access to fertility treatment is a huge problem and it’s almost completely dependent on how wealthy you are. Yet even for those who can afford it, it’s still a hugely expensive process without any guarantee of a child. The lack of personalisation also means most people don’t properly understand their chances. You would struggle to find any other examples in healthcare where people spend that much money without understanding the risk of success or failure. Everyone is playing an emotional lottery doing round after round of IVF and hoping for the best.”

To read the full report – follow this link.

-Ends-

Notes to editors:

- NHS – https://www.nhs.uk/conditions/infertility/

- Pitchbook data – 2016-2021.

- HFEA data – 1991-2019

- https://www.ons.gov.uk/ – The age of parenthood in the UK has risen steadily between 1975 and 2019. Increasing from 26.4 to 30.7 in mothers, and 29.4 to 33.6 in fathers.

For journalists in their professional capacity only. Personal opinions may change and should not be seen as advice or a recommendation. We do not offer investment or tax advice. Issued by Octopus Investments. Octopus Ventures is part of Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London, EC1N 2HT. Registered in England and Wales No. 03942880. Issued: September 2021.