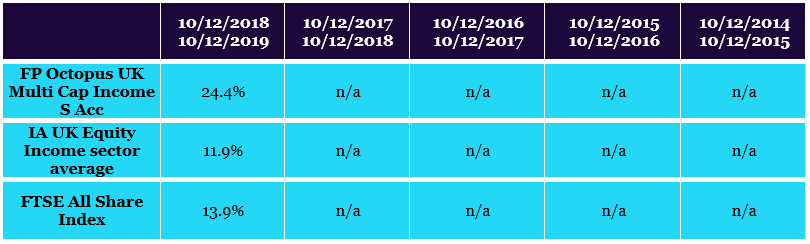

The FP Octopus UK Multi Cap Income Fund, launched by Octopus Investments last December, has outperformed every other fund in the 86-strong IA UK Equity Income Sector in the year since launch, well above the 11.9% sector average.

The Fund’s performance has been driven by its diversified portfolio of big, small and medium-sized companies spread across the entire market, albeit with a bias towards faster growth, small and mid-cap equities. It has looked to provide both growth and income, seeking out dividend-paying companies beyond the usual large-cap ‘income stalwarts’.

Its approach of building a portfolio of companies capable of generating growth in both earnings and income has paid off. By investing across the entire market spectrum, the Fund has been able to navigate the challenges experienced by the markets over the last 12 months and deliver a solid performance for investors.

All stocks within the portfolio pay a dividend, whether they are the more established, large-cap dividend payers, some with solid international franchises, or the complementary, faster growth opportunities often in smaller, more domestic focused companies.

All businesses included within the portfolio are assessed on their ability to bring at least one of three characteristics to the Fund: the ability to deliver faster than market earnings growth, to drive faster than market dividend growth, or generate a better than market dividend yield.

This versatile multi-cap approach has allowed fund manager Chris McVey to continue to find value for investors at both the large and smaller company ends of the market, despite the challenging UK equity environment.

This multi cap perspective also offers investors diversification when seeking income, particularly pertinent as just 10 stocks currently represent over 50% of FTSE 100 dividend payments. The Fund’s dividend cover is currently 2.2x, compared to just 1.4x for the UK’s 10 highest dividend payers.

The FP Octopus UK Multi Cap Income Fund is ultimately designed to deliver better than market earnings growth aiming to drive capital performance for investors, coupled with a dividend comparable with the FTSE All Share, paid quarterly, while growing at a faster rate than the wider market.

Chris McVey, manager of the FP Octopus UK Multi Cap Income Fund, comments:

“Our multi-cap strategy offers investors a diversified approach to generating equity income. As our Fund isn’t constrained by investing in any one part of the market this allows us to apply stringent criteria to our stock selection, including a focus on how reliable the dividend is, and an assessment of the growth opportunity across the portfolio from both a capital, and an income perspective.”

“We launched the FP Octopus UK Multi Cap Income Fund as we were confident that our deep experience in investing in small and mid-cap companies would allow us to identify businesses with strong potential, that could offer a more diverse source of investor income. The fund’s outperformance this year is testament to the benefits of taking a multi-cap approach. It blends smaller, high-growth businesses with larger, longer established companies to provide investors with a diverse source of attractive, growing, income as well as better than market capital performance.”

-Ends-

Please note past performance is not a reliable indicator of future results.

Risks to bear in mind: The value of any investment can fall or rise, and you may not get back the full amount you invest. Smaller company shares are also likely to fall and rise in value more than shares in larger, more established companies listed on the main market of the London Stock Exchange. They may also be harder to sell. For the FP Octopus UK Multi Cap Income Fund, fees will be deducted from capital which will increase the amount of income available for distribution. However, this will erode capital and may hinder capital growth.

Source: Lipper. Returns are based on published dealing prices, single price mid to mid with net income reinvested, net of fees, in sterling.

For journalists in their professional capacity only. The value of an investment, and any income from it, can fall as well as rise. Investors may not get back the full amount they invest. Yield is not guaranteed. Investments in smaller and/or medium sized companies are likely to fall and rise in value more than shares listed on the main market of the London Stock Exchange, they may also be harder to sell. Fees will be deducted from capital which will increase the amount of income available for distribution. However, this will erode capital and may hinder capital growth. Personal opinions may change and should not be seen as advice or a recommendation. We do not offer investment or tax advice. We recommend investors seek professional advice before deciding to invest. Before investing you should read the Prospectus, the Key Investor Information Document (KIID) and the Supplementary Information Document (SID) as they contain important information regarding the fund, including charges, tax and fund specific risk warnings and will form the basis of any investment. The Prospectus, KIID and application forms are available in English at investments-old.production.octps.co. The ACD of the FP Octopus UK Multi Cap Income Fund is FundRock Partners Ltd which is authorised and regulated by the Financial Conduct Authority no. 469278, Registered Office: Cedar House, 3 Cedar Park, Cobham Road, Wimborne, Dorset BH21 7SB. Issued by Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London, EC1N 2HT. Registered in England and Wales No. 03942880. Issued: December 2019.