Global investment over five-year period tops $2.2bn – rising to $750m last year

The fertility industry is ripe for disruption, according to new analysis from London based VC firm, Octopus Ventures. Innovative new start-ups are leading the charge, which has been followed by an increase in VC funding, a trend which is expected to gather pace in the coming years.

The Octopus Ventures study found that global VC investment in fertility-related start-ups increased nearly four-fold between 2014 and 2019, with total investment reaching $2.2 billion during that period1.

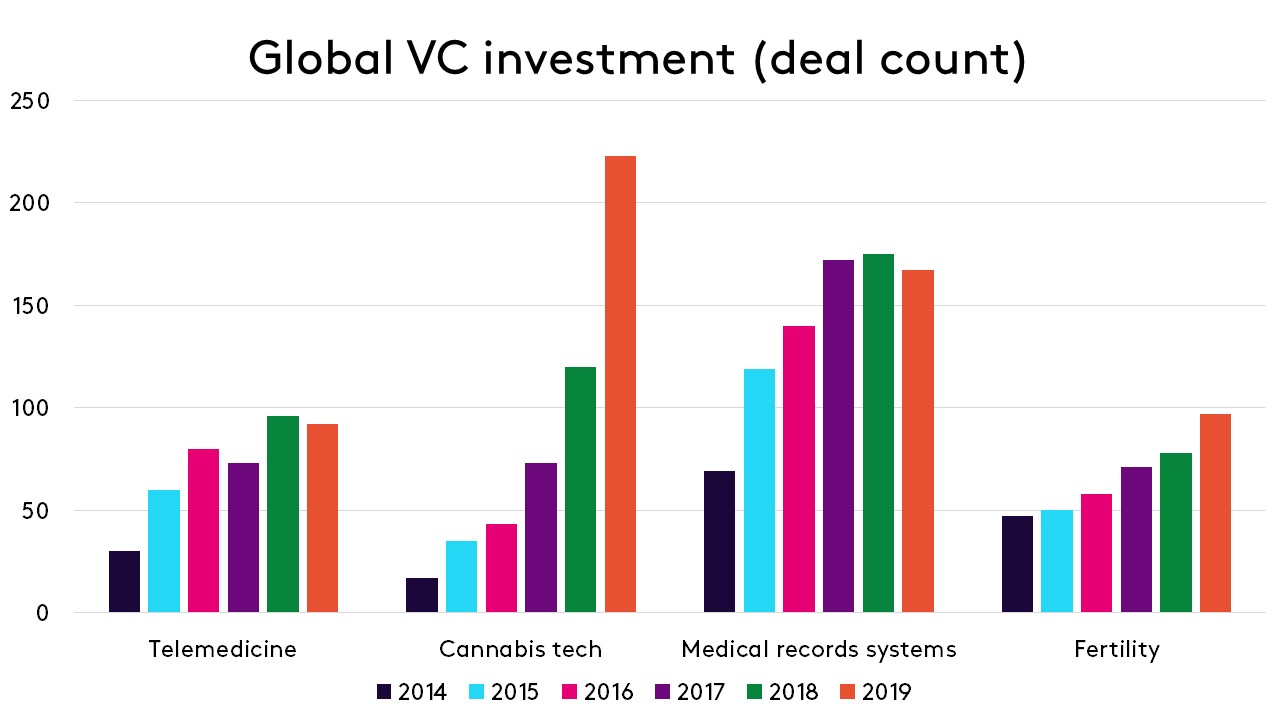

The study tracked total deal count in the sector, which has doubled in the same time period – up from 47 in 2014 to 97 in 2019. The latest data also shows that funding rounds are increasing in size, with the average round equating to $7.73M in 2019, compared to only $4.1M in 2014.

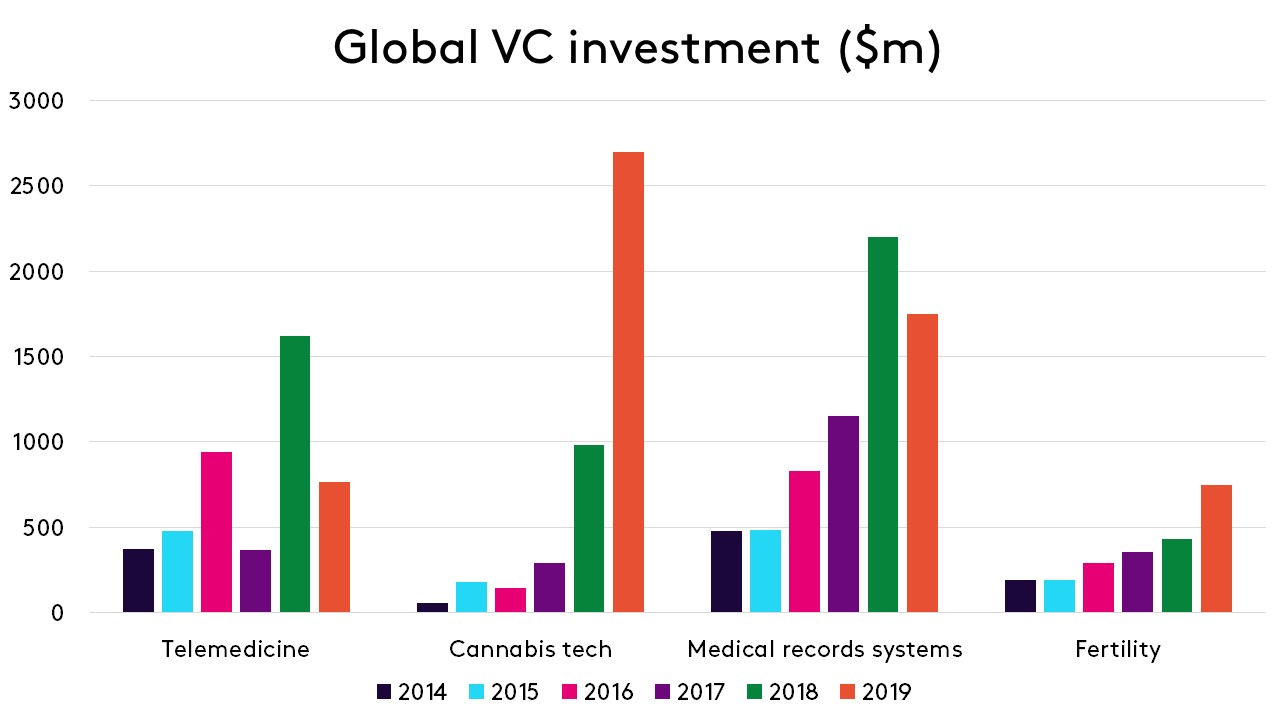

Yet this figure is dwarfed by the $7bn invested by VCs into Medical Records Systems over the same time period, while other sectors such as telemedicine, and cannabis-related start-ups have both received twice as much VC investment as fertility companies over the same period.

| Global VC investment per year – 2014 to 2019 | |||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 5-year total | |

| Medical Records Systems | $480m | $485 | $830m | $1.15bn | $2.2bn | $1.75bn | $7bn |

| Telemedicine | $370m | $480m | $940m | $365m | $1.62bn | $765m | $4.5bn |

| Cannabis Tech | $55m | $180m | $145m | $290m | $980m | $2.7bn | $4.4bn |

| Fertility | $193m | $191m | $292m | $353m | $430m | $750m | $2.2bn |

Growth in investment into fertility-related start-ups has been steady compared to telemedicine, cannabis tech and medical records systems – all of which have seen a significant spike in investment over the past 5 years.

Despite the gradual increase in investment, the Octopus Ventures market analysis identified significant latent demand for innovation in fertility treatment and an industry ripe for investment:

- Infertility rates among both men and women have been rising for 60 years, particularly in industrialised countries2.

- Men’s sperm counts have more than halved in the last 40 years3, with a variety of environmental factors cited as the cause.

- One in seven UK couples report difficulties conceiving4.

- The latest figures from the Human Fertility and Embryology Authority indicate an almost 60% increase in the number of UK patients undergoing IVF treatment – up to 54,000 in 20175 from around 31,000 in 20046.

While there has been a significant increase in the number of people actually receiving fertility treatment, the number of people seeking treatment is likely to be much higher.

According to Octopus Ventures, the number of new innovations in the sector combined with huge latent demand indicates the potential for a surge in investment into the sector in the coming years, as promising early-stage start-ups begin to grow and scale to meet this demand.

Estimated to be worth $25 billion7, the fertility industry has been dominated by large clinics, all offering very similar treatments at similar price points. Despite its size, innovation has lagged behind other areas of healthcare, with options for those looking to conceive remaining prohibitively expensive for many, and often ineffective.

Human egg development, artificial womb research, tissue freezing (ovarian and testicular), male contraception and machine learning for embryo selection are some of the areas of scientific research set to change the face of the fertility sector over the next decade.

However, some technologies are already being offered to consumers in the form of mobile tracking and diagnostic apps, while other start-ups allow employers, including LinkedIn and Goldman Sachs, to build fertility treatments into their staff benefits packages.

Kamran Adle, early stage investor in the Future of Health team at Octopus Ventures, comments:

“Fertility treatments are genuinely life changing for many people, but there has been a lack of innovation in this area for a number of decades, which is reflected in the relative underinvestment compared to other sectors and indicative of the early stage science involved.

“As a result, innovation has lagged behind other areas of healthcare, with options for those looking to conceive remaining expensive. The focus has generally been on IVF that places women at the centre of the process, with ‘Men in white coats’ the accepted interface for lengthy and sometimes distressingly ineffective experiences the norm.

“Significant scientific and technological advances mean this is now starting to change, and there are some talented entrepreneurs building very exciting start-ups in the space. We believe many of them have the potential to radically disrupt the industry and backing from VCs will be crucial to driving this change.

“The trend is clear to see. As fertility rates continue to decline, demand for fertility treatments will continue to rise, but not everyone who wants treatment can access it. That’s where we see the big opportunity in the coming years, with new technologies and services enabling new treatments that are cheaper and more scalable. Ultimately, this presents a huge opportunity to transform patient outcomes and should make having a baby much more accessible to all.”

– Ends –

Notes to Editors:

Sources:

1 Pitchbook data

2 https://www.ivi.uk/blog/rise-infertility-rates-uk/#

3 https://www.nhs.uk/news/pregnancy-and-child/western-sperm-counts-halved-in-last-40-years/

4 https://www.nhs.uk/conditions/infertility/

5 https://www.hfea.gov.uk/about-us/news-and-press-releases/2019-news-and-press-releases/ivf-more-popular-successful-and-safer-than-ever-but-reasons-for-treatment-are-changing/

6 http://news.bbc.co.uk/1/hi/health/7131522.stm

7 https://www.databridgemarketresearch.com/reports/global-fertility-services-market

Study findings:

Global Fertility Industry:

Global Fertility Deal Count & Capital Raised by year:

- 2014: 47, $193M

- 2015: 50, $191M

- 2016: 58, $292M

- 2017: 71, $353M

- 2018: 78, $430M

- 2019: 97, $750M